Our Models Perform

Our innovative tactical model portfolios have consistently outperformed their benchmarks. They have done this while lowering the overall portfolio drawdowns when the market trends lower. We utilize advanced algorithms which are based on nobel prize winning research and extensively tested on real world data.

Our tactical model portfolios are based on momentum investing. Much like the theory of momentum in physics, the momentum theory in investing states that a body in motion tends to stay in motion. Further, the theory states that investments that have had strong performance relative to their peers (relative strength) tend to do better in future periods than investments that had weak relative strength. The theory is backed by an enormous amount of academic research, most notably a study by Eugene Fama of the University of Chicago. Fama had previously authored the efficient market theory which stated that it was impossible to outperform the market. His subsequent research determined that momentum was a robust market anomaly that when applied could in fact, lead to market outperformance. We have tested the concept of momentum on decades of real world data and the results have demonstrated that momentum based strategies can produce superior returns.

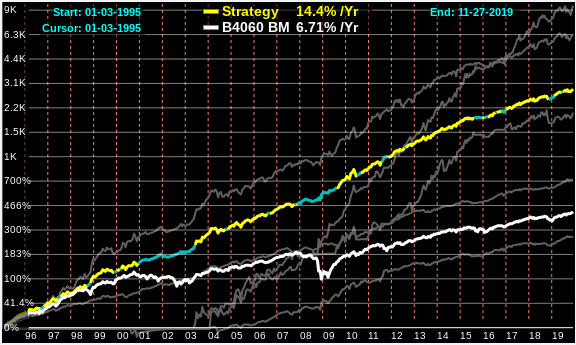

Our tactical models use the theory of momentum and a powerful algorithm to determine which sectors of the market and which styles of investment are most likely to perform well in the future. The algorithm selects several Sector ETFs, one broad based style ETF (ie. the S&P 500 Growth ETF), and several bond ETFs. When markets are trending lower and the algorithm signals danger the model sells stocks and keeps the proceeds in safe assets like cash and bonds until the market conditions improve. The green sections of the colored line in the chart below represent periods when the model moved to safe assets. Our tactical model portfolios have 4 different levels of risk, suitable for investors at different stages of their investing journey.

Stonebrook Moderate Tactical Model Portfolio

60% Stocks 40% Bonds

* 1/3/1995-11/27/2019. Past performance is no guarantee of future results.

The Stonebrook Moderate Tactical Portfolio is a Moderate risk portfolio made up of ETFs. It is risk managed to protect your assets when markets trend lower. The model seeks to own the strongest sector ETFs along with the strongest factor ETF.

Stonebrook Conservative Tactical Model Portfolio

40% Stocks 60% Bonds

* 1/3/1995-11/27/2019. Past performance is no guarantee of future results.

Stonebrook Aggressive Tactical Model Portfolio

80% Stocks 20% Bonds

* 1/3/1995-11/27/2019. Past performance is no guarantee of future results.

Past performance is no guarantee of future results. Click here for disclosures on how performance is calculated and other important information.

No part of this website is intended to be investment recommendations to any specific person or group.

Fees for tactical portfolios are 0.70% of asset value per year. Fees for passive portfolios are 0.50% per year. Fees are billed quarterly in advance. There are no transaction costs associated with the program. Minimum account value is $1,000. Click here for a copy of our ADV part II.